Skip to content, Skip to main navigation

Investor Insights > News > A note from Dan: Are US assets becoming less desirable?

.jpg)

A note from Dan: Are US assets becoming less desirable?

May 2025

There has been so much commentary, including by us, on the twists and turns of US trade policy - notwithstanding the latest 90-day truce with China - that what can be said has already been said.

For now, it's sufficient to say that globalisation, greater trade, and capital markets liberalisation, which have been dominant themes for decades, is in the process of being replaced with a modern form of mercantilism in which the state intervenes to support industries and companies to achieve greater national wealth, strength, and self-sufficiency.

While the exact form this new global order will take is imprecise, its outlines appear to be something along the lines of a world divided into great power spheres of influences in which “the strong do what they can and the weak suffer what they must.”1

Against a backdrop in which the United States is seemingly abandoning its role as the global system anchor, there is a live investment community conversation on whether there may also be a repricing of risks around US assets, and even questions over the desirability of US assets.

The issue is so consequential and multifaceted that it needs to be approached with care and nuance rather than rushing headlong into black and white conclusions. The danger of definitive conclusions, when so much is at stake, is the high risk of ending up with egg on the face and making poor investment decisions on imperfect information.

Questions over US dollar's status seem premature

While the US' standing as the world's largest and deepest capital market is not remotely under threat, disorder and disruption coming out of Washington is causing investor disquiet. This in part stems from the gap between institutional investors' economic orthodoxy versus a US administration whose economic philosophy is hard to pin down, beyond characterising it as 'transactional.'

Ideally, investors want pro-market policies featuring fiscal restraint, action to curb galloping public debt, light-touch regulation, free trade, and low taxes.

Instead, despite generating lots of headlines, Elon Musk's Department of Government Efficiency (DOGE), which initially targeted an extremely ambitious US$2 trillion in government spending cuts, then downgraded to targeting US$1 trillion savings, now claims just US$160 billion in savings. 2

The figure hardly moves the needle in the direction of fiscal restraint against annual US federal government spending of around US$6.8 trillion. 3

Moreover, US government spending in the first 100 days of President Trump's second administration has jumped 10% compared to the same period in the previous year. 4 Then, of course, there is uncertainty from the back and forth on tariffs, as well as apprehension over potentially unfunded tax cuts.

All up, you have a cocktail that is inducing investor apprehension showing up, amongst other things, in US dollar weakness, albeit still short term, with the greenback estimated to have lost around 10% of its value since Inauguration Day. 5

US dollar weakness is striking because countries that impose tariffs usually see their currency rise. However, the untidy rollout of the administration's tariff plans has bewildered investors and a general lack of transparency in terms of motivations have led to a sense of financial markets unease.

For decades, the US dollar, the Swiss franc, and Japanese yen were among the most popular options for investors seeking shelter in volatile markets.

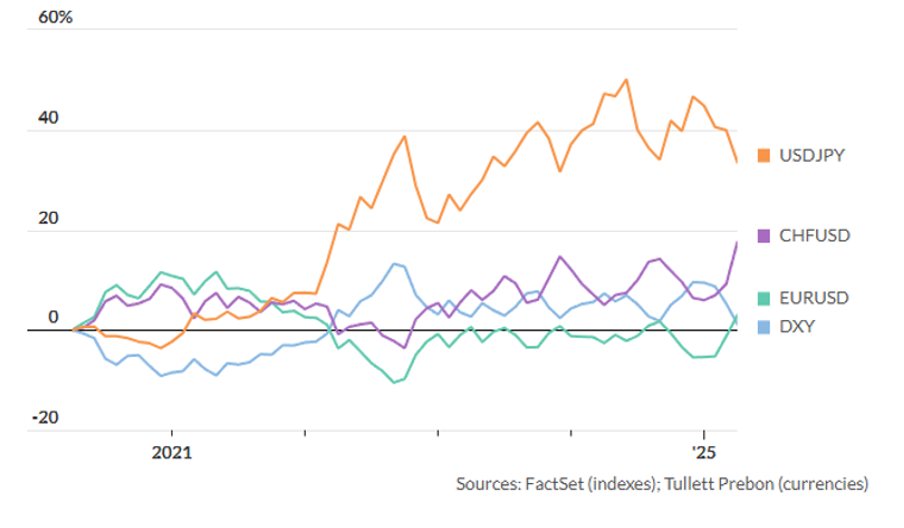

While the yen, Swiss franc, and euro have gained value over recent months, the ICE US Dollar Index, a well-known gauge of the US dollar's value against its main currency rivals, has slid (Chart 1).

Legend: USDJPY = US dollar vs Japanese yen

CHFUSD = Swiss franc vs US dollar

EURUSD = Euro vs US dollar

DXY = ICE US dollar Index

Source: FactSet (Indices); Tullett Prebon (currencies)

To be clear, the latest selloff was not the first time that global confidence in the US dollar has been challenged. The greenback struggled during the early days of the Global Financial Crisis (GFC), beginning around mid-2007, when investors initially viewed the mortgage-bond meltdown as a uniquely American problem.

However, by the time the European debt crisis was triggering bailouts in 2011, confidence in the greenback had been restored.

Arguably, things feel different this time as US economic policy seems intended to undermine a system that Washington previously underwrote.

The policy shake-up not only threatens to undermine the dollar's safe haven status during times of market stress, it also could erode the dollar's status as the de facto global currency and possibly unleash a host of negative consequences, including higher borrowing costs for the US government and consumers.

During the GFC there wasn't a movement in the US to dismantle the international trading system or the international financial system because US policymakers were actively trying to save the system.

Now there is a perception that not only have motivations changed, but so have methodologies. It speaks to a US that is no longer the underwriter of its own system. Instead, the US is going about dismantling that system in an abrupt way.

That said, any shift away from a system that places the dollar at the centre of global commerce likely won't happen overnight.

By some measures, the world has been gradually shifting away from its dependence on the dollar for decades with International Monetary Fund data showing the dollar's share of global central bank reserves has been declining since the late 1990s. 6

However, its dominance in trade remains largely undiminished. According to data from Swift, an international interbank payments network, the dollar remains involved in nearly half of all global transactions. 7

In other words, reports of the US dollar's demise are overdone.

Threats to US equity market exceptionalism

On to share markets where some voices question the viability of continuing US equity dominance.

While US equity market dominance is accepted by the current generation of investors as simply the status quo, it's useful to remind ourselves that this has not always been the case.

Around 2010, the split between stocks listed in the US versus non-US in the MSCI World Index was roughly 50:50. By the end of December 2024, however, US stocks comprised about 74% of the index 8 as US domiciled technology stocks driven by the Magnificent Seven (Apple, Microsoft, Amazon, Alphabet, Tesla, Meta, and Nvidia) overshadowed everyone else.

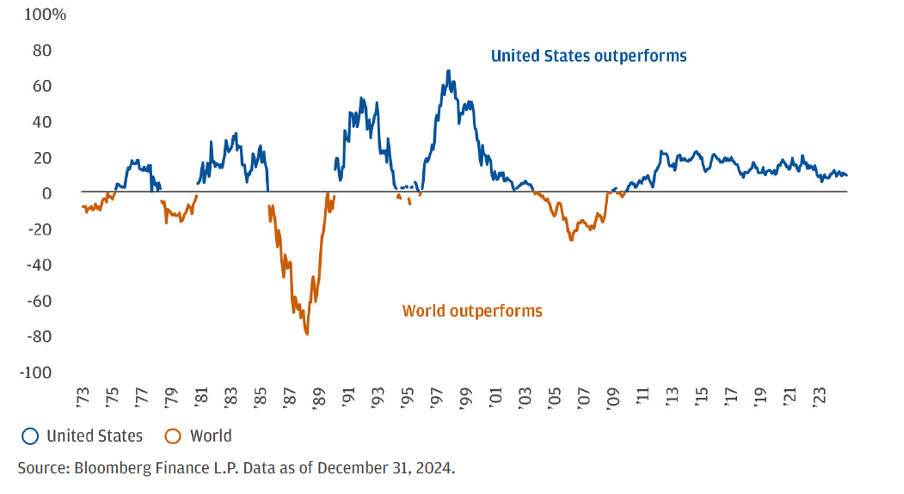

Prior to the onset of the GFC, cycles of alternating outperformance were the norm. Since 1970, US stocks have delivered five periods of outperformance, averaging 96 months, while world markets have delivered four periods of sustained outperformance, averaging 45 months. 9

Relative performance metrics look similar over shorter periods too. The US has outperformed world markets in more than 70% of three-year rolling periods since 1969, including all three-year periods since the start of 2010. 10

However, markets are cyclical, and the US has not always dominated and so it is possible that share market leadership may flip from the US to the rest of the world, as it has done in the past (Chart 2).

Chart 2: Might share market leadership change from the US to non-US?

US (S&P 500) excess returns over rolling three-year periods (1969–2024)

The most recent period of US stock market outperformance has been supported by positive economic and financial drivers, but these may be vulnerable to shifting macroeconomic forces and geopolitical risks.

Since mid-2008, the S&P 500 has beaten the MSCI EAFE Index (this index measures the performance of large and mid-cap companies across developed markets countries, excluding the US and Canada), by a sizable margin, delivering average annual returns of 11.9% versus 3.6% through December 2024. 11

Over the same period, the S&P 500 grew earnings four times faster than MSCI EAFE and boasted price-to-earnings (P/E) multiple expansion of 12.8x to 21.7x, compared to the MSCI EAFE's expansion of 11.3x to 14.0x. 12

Using return on equity (ROE) as a measure of how efficient companies are with their equity capital, the S&P 500 has maintained a higher ROE than the MSCI EAFE Index since June 2008, and that spread has widened over time. 13 Currently, ROE for the US market is 19% versus 12% for EAFE. 14

We think several factors have driven that difference, including US technological innovation, more efficient operations and shareholder-friendly government policies, such as corporate tax cuts.

The combination of higher earnings growth and ROE have led investors to place a higher P/E multiple on the US equity market. At the start of 2025, the US stock market premium versus EAFE on a forward P/E basis was hovering at 55%, near its all-time high, although recent market volatility has narrowed the gap. 15

In this context, it's easy to see how the booming tech sector has contributed to US earnings growth and multiple expansion.

What may cause shift in market leadership?

US share market exceptionalism has been a powerful trend, but it is arguable that risks, especially in the tech sector, are rising.

Recall what happened in late January when the announcement that Chinese AI startup DeepSeek had developed and launched a competitive large language model pushed US tech stocks' valuations sharply lower.

Uncertainties about the direction of US economic and foreign policy have grown and consumer sentiment appears to be weakening.

To be clear, investors expect US earnings to keep growing but for US outperformance to persist, US company earnings will have to grow faster than those outside the US.

That may not be so easy to do. As soon as the news about DeepSeek broke, for example, the US market's relative valuation to the MSCI EAFE dropped from 55% to 49% and declined more recently to around 39%. 16

Recent market events underscore how vulnerable US equities may be to higher tech-stock volatility, disruption from tariffs, and cresting US consumer confidence.

With all that's coming out of Washington these days, it is understandable that people are looking for cracks in America's financial and economic dominance.

When doubts emerge, it's timely to be reminded of a Warren Buffet quote: "In its brief 232 years of existence ... there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country's economic progress has been breathtaking. Our unwavering conclusion: Never bet against America." 17

As robotics and artificial intelligence emerge as the latest sources of technological advancement and economic growth, the US boasts leadership in these arenas, notwithstanding ripples created by DeepSeek.

The US Federal Reserve continues to be the central bank that sets the direction for global interest rates, credit creation, and on it goes.

A rich investment approach

The themes discussed in this note are captured by our rich investment process which draws far and wide for insights. Both short and longer term economic and asset class dynamics are analysed, as are structural themes.

Moreover, we actively interrogate the many ways in which markets and economies may progress rather than dogmatically settling for a base case and making investment decisions through a narrow lens.

As ever, we have leaned on our asset allocation and diversification expertise to steer our clients' portfolios through this year's market volatility.

Recognising that US stocks, led by the Magnificent Seven, had become a disproportionate part of the global share market, and the risks this posed, we have had an 'underweight' position to the US share market for some time and instead deployed more of our clients' funds to non-US markets, which we judge as being better valued.

We have also maintained our exposure to alternative investments, like insurance related investments, which provide an attractive source of diversification given their performance is not related to share markets.

We hold real assets via unlisted infrastructure and unlisted property investments, which provide diversification benefits, along with long-term, stable and predictable cashflows often linked to movements in inflation.

In our view, higher macroeconomic uncertainty works against 'swinging for the fences' asset allocation moves. Instead, the emphasis is on fine-tuning portfolios and skilful risk management so that they can play both defence and offence.

On the defensive part of the equation, we have in place derivatives strategies that can protect portfolios should the US equity market weaken. By the same token, our portfolios' strong liquidity has meant that we have been able to acquire assets at attractive valuations on the back of recent disruptions.

1 Quote is from Thucydides' History of the Peloponnesian War

2 DOGE says it has saved $160 billion. Those cuts have cost taxpayers $135 billion, one analysis says. https://www.cbsnews.com/news/doge-cuts-cost-135-billion-analysis-elon-musk-department-of-government-efficiency/

3 How much does the US federal government spend? https://usafacts.org/answers/how-much-does-the-us-federal-government-spend/country/united-states/

4 How much has the US government spent this year? https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

5 Investors dodge US dollar and Treasuries, scared by Trump's trade war, https://finance.yahoo.com/news/investors-dodge-u-dollar-treasuries-132101903.html?guccounter=2

6 Dollar dominance in the international reserve system: An update. Serkan Arslanalp, Barry Eichengreen, Chima Simpson-Bell, 11 June 2024, https://www.imf.org/en/Blogs/Articles/2024/06/11/dollar-dominance-in-the-international-reserve-system-an-update

7 The US dollar's role as the de facto global reserve currency is looking increasingly uncertain. Joseph Adinolfi, 16 April 2025, https://www.morningstar.com/news/marketwatch/20250416172/the-us-dollars-role-as-the-de-facto-global-reserve-currency-is-looking-increasingly-uncertain

8 Are you ready to embrace the potential of global equities? Andrew VanWazer, 25 March 2025, JP Morgan

9 Ibid

10 Ibid

11 Ibid

12 Ibid

13 Ibid

14 Ibid

15 Ibid

16 Ibid

17 Berkshire Hathaway annual letter to shareholders, 27 February 2021, https://berkshirehathaway.com/letters/2020ltr.pdf

You may also be interested in

This article has been prepared for OnePath Custodians Pty Limited (OPC) ABN 12 008 508 496, AFSL 238346 as Trustee of the Retirement Portfolio Service (ABN 61 808 189 263). OPC is part of the Insignia Financial group of companies comprising Insignia Financial Limited ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).

The information in this article is current as at May 2025 and may be subject to change.

You should read the relevant Financial Services Guide (FSG), Product Disclosure Statement (PDS), Target Market Determination (TMD), Additional Information Guide (AIG), Investment Funds Guide (IFG), and product and other updates (for open and closed products) available at onepath.com.au and consider whether OnePath products are right for you before making a decision to acquire, or to continue to hold any OnePath product. Alternatively, you can request a copy of this information by calling Customer Services on 133 665.

Taxation law is complex, and this information has been prepared as a guide only and does not represent taxation advice. Please see your tax adviser for independent taxation advice.

Before re-directing your super or moving your money into your product, you will need to consider whether there are any adverse consequences for you, including loss of benefits (e.g. insurance cover), investment options and performance, functionality, increase in investment risks and where your future employer contributions will be paid. Any investment is subject to investment risk, including possible repayment delays and loss of income and principal invested. Returns can go up and down. Past performance is not indicative of future performance.

The information provided is of a general nature and does not take into account your personal needs, financial circumstances or objectives. Before acting on this information, you should consider the appropriateness of the information, having regard to your needs, financial circumstances or objectives. The case studies used in the articles on this website are hypothetical and are not meant to illustrate the circumstances of any particular individual. Opinions expressed in this document are those of the authors only.