Skip to content, Skip to main navigation

Investor Insights > News > A note from Dan: the AI investment paradox

.jpg)

A note from Dan: the AI investment paradox

September 2025

While tech giants' share prices have soared, businesses are still figuring out how to make AI work for them.

“People often overestimate what will happen in the next two years and underestimate what will happen in ten.”

Bill Gates1

Investors who navigated the late 1990’s internet mania are likely experiencing a case of déjà vu.

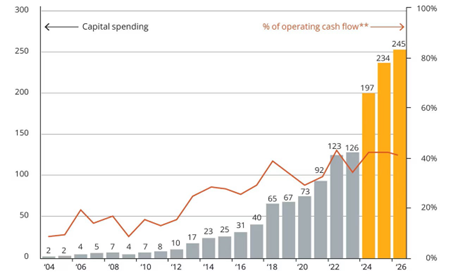

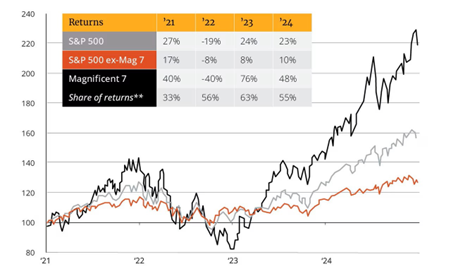

Once again, we’re in the midst of a technological revolution — this time, driven by artificial intelligence (AI) — attracting enormous capital (Chart 1) and generating eye-catching share price gains for companies seen to be at the leading edge (Chart 2), like the Magnificent Seven (Apple, Amazon, Alphabet, Meta Platforms, Microsoft, NVIDIA, and Tesla).

Chart 1: Surging AI-related investments

Capital expenditure from major AI hyperscalers*

US$ billions: Alphabet, Amazon Web Services, Meta Platforms, Microsoft, Oracle

Data for 2024, 2025, and 2026 reflects consensus estimates. Capital expenditure is company total, except for Amazon, which reflects an estimate for Amazon Web Services spend (2004 to 2012) are JP Morgan Asset Management estimates, and 2012 to current are Bloomberg consensus estimates. *Hyperscalers are the large cloud computing companies that own and operate data centres with horizontally linked servers that, along with cooling and data storage capabilities, enable them to house and operate AI workloads. **Reflects cash flow before capital expenditures in contrast to free cash flow, which subtracts out capital expenditures.

Data as at 31 December 2024

Source: JP Morgan Asset Management

Privately held OpenAI, the company behind ChatGPT and the trigger for the AI wave, has seen its valuation skyrocket. From around US$20 billion in 20212 to an estimated US$300 billion in March, this year, (following a funding round led by Japanese investment company SoftBank),3 OpenAI has increased in value fifteenfold in just four years.

Chart 2: Outsized returns from the Magnificent Seven

Performance of Magnificent Seven in S&P 500

Indexed to 100 on 1 January 2021, price return

Earnings estimates for 2024 and 2025 are forecasts based on consensus analyst expectations. **Share of returns represent how much each group contributed to overall returns. Numbers are always positive despite negative performance in 2022.

Data as at 31 December 2024

Source: FactSet, Standard & Poor’s, JP Morgan Asset Management

A paradox emerges

While these tech giants’ investors have enjoyed thumping gains, businesses adopting AI have so far reported underwhelming productivity or profitability improvements.

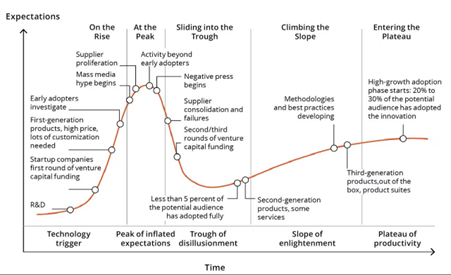

The Gartner Hype Cycle provides an insight into this disconnect, illustrating a common trajectory for new technologies — from inflated expectations to eventual widespread productivity (Chart 3).

According to Gartner, AI is moving through the Trough of Disillusionment, a phase where early hype gives way to the hard realities of integration and operational challenges.4

Chart 3: The Gartner Hype Cycle helps to explain AI, as well as previous technological adoptions

Source: Gartner Inc.

This phase also intimates that while we may witness a dip in excitement as projects stall or fail to meet grand expectations, the surge in research, investment, and foundations being laid are very real and should eventually deliver meaningful benefits. The next 1–2 years are expected to be critical for AI to deliver tangible returns and begin to substantially lift mainstream business productivity.5

This pattern mirrors the late 1990s internet boom where early excitement got ahead of practical business applications until companies mastered integration, leading to transformative outcomes. The current phase indicates that while AI's potential is undeniable, businesses must navigate a period of testing and learning, and refinement to achieve scalable impact.

Not-so-great results for businesses, so far

McKinsey estimates that AI could unlock between US$11–US$18 trillion in value, especially in marketing (personalisation and segmentation), sales (lead scoring), and supply chain optimisation (inventory and forecasting).6 Yet, over 80% of businesses surveyed said generative AI7 has not yet had a material impact on enterprise-level earnings before interest and tax (EBIT).8

Notably, 75% of companies in McKinsey’s study had already adopted AI tools. Even among early adopters, enterprise-wide improvements remain elusive, despite implementations across marketing, product development, IT, operations, and software engineering.

The story is consistent from other sources. A RAND Corporation study found that AI initiatives fail at double the rate of traditional IT projects,9 while a Bain study similarly noted that most firms remain “stuck,” unable to move beyond pilot-stage implementation.10

From micro gains to macro impact

Many current applications of AI deliver “micro-productivity” improvements — automating emails, scheduling, or document drafting. While helpful, these enhancements rarely transform the economics of a business.

Experts argue that unlocking AI’s full potential requires enterprise-wide vision and strategic focus. Rather than diffuse, piecemeal experimentation, success typically comes from top-down initiatives prioritising a handful of high-impact areas. These often involve reimagining core workflows, building data infrastructure, and upskilling teams.

A book published well before today’s AI boom and after the bursting of the internet bubble; Engines that move markets: Technology investing from railroads to the internet and beyond, presciently sums up the current situation:

“There were several years of strong share-price growth when the railways were supplanting canals. The bubble of the 1840s deflated under the weight of overheated expectations and changing economic conditions……Any technological advance which requires huge capital expenditure always runs a real risk of disappointing returns in the early years, even if it is ultimately successful... …The winners of these competitive struggles are not always those who have the best technology, but those who can most clearly see the way that an industry or market is likely to develop.”11

Tomorrow’s winners may not be today’s leaders

So which companies might turn out to be the winners in the AI race? History suggests they may not be the ones dominating today’s headlines.

From 1995 to 2025, only five firms — Microsoft, Oracle, Cisco, IBM, and AT&T — remain among the top 30 most valuable global tech companies.12 Many of today’s AI leaders, including NVIDIA, Alphabet, Meta Platforms, and Palantir, didn’t even exist at the turn of the century.

They may be eclipsed by presently unknown companies, though the pricey economics of AI implies that today’s industry giants should remain competitive.

The estimated cost of training the large language model (LLM) for ChatGPT-4 (2023) was said to be around US$100 million.13 Training costs for frontier models are growing 2–3 times annually, with estimates suggesting costs could reach US$1 billion by 2027 and up to US$10 billion by 2030 for the largest models.14

Deep pockets are needed to compete in AI and as of now, that would seem to leave industry incumbents well-placed to remain relevant, at the very least.

Data centres provide another way of accessing AI theme

Investors don’t have to limit their exposure to companies building frontier AI models. Data centres — the physical infrastructure powering AI — likened by NVIDIA CEO Jensen Huang to “AI factories,” present another investment pathway.

Here’s a snapshot of demand and capital expenditure expectations for data centres:15

- In 2024, data centres accounted for 1.5–2% of global electricity use. By 2030, this is forecast to more than double — roughly equal to Japan’s total energy consumption.

- In the US, data centres are expected to drive nearly 50% of electricity demand growth through 2030, requiring US$50 billion in new generation capacity for data centres alone

- Global data centre market capacity is projected to grow from 55–59 gigawatts (GW) in 2023 to between 171–219 GW by 2030 — a cumulative annual growth rate (CAGR) of 19–22%. In a high-growth scenario, it could hit 298 GW, with up to US$7.9 trillion in capex required.

It’s easy to be beguiled by such projections and this has contributed to a hefty rise in data centres’ entry valuation multiples over the recent past, suggesting significant business growth assumptions are being baked into valuations.

Consequently, valuation discipline is required or investors risk overpaying for highly coveted assets. Some investors are gravitating towards adjacent infrastructure — such as fibre networks that bring connectivity to data centres and connect data centres with each other and with homes, and electricity networks that support power required in data centres — as attractive alternatives.

Our infrastructure investment program has meaningful exposure to digital assets across data centres, fibre connections, and telecommunication towers and by doing so are benefiting from a structural tailwind.

Client portfolios are participating in Goodman Group, Sonic Healthcare, BHP, and a clutch of global names

One of our equity holdings, Goodman Group, a major developer of logistics and warehouse space globally, is a prominent example of how real estate is pivoting toward AI-driven infrastructure. Over half of Goodman’s nearly A$14 billion development work-in-progress pipeline is now dedicated to data centres spanning the US, Europe, Asia, and Australia.16

Two further examples from Australian companies held in portfolios we manage for our clients — Sonic Healthcare, and BHP — powerfully illustrate the multifaceted nature of AI. Technologies typically perform a narrow range of functions exceptionally well. AI, by contrast, is both a horizontal as well as vertical capability.

Sonic Healthcare provides medical services including radiology, and general practice medicine, however, pathology accounts for around 85% of the company’s revenue.

Pathology margins are constantly under pressure as payers — governments and insurers — are not inclined to increase pathology reimbursements, even as costs rise on the back of new and more expensive diagnostic equipment, and specialist and employee remuneration. For its part, Sonic cannot simply increase prices at the rate of cost increases.

Subsequently, lifting productivity is key to margin-protection. Streamlining collections and higher throughput have been two traditional ways of doing so. Now, Sonic, in concert with a joint-venture partner, and in a first stage medical trial, is leaning on AI diagnostic tools to conduct first step analysis of biopsies to shave costs as well as speed up diagnosis.

There are other benefits too for Sonic. Medical trials usually culminate in binary outcomes — if successful, trials can progress and hopefully, commercialised. If unsuccessful, the journey ends with no compensation for costs involved.

However, even if the current trial ends unsuccessfully, AI can use data and insights gained for other projects. So, at the very least, AI improves the economics of such exercises.

BHP, the world’s biggest resources company, has been using autonomous vehicles at mining sites, and AI for predictive maintenance. It’s also deploying AI to improve workplace safety by providing employees with helmets that monitor brainwaves to detect signs of fatigue.

Meanwhile, our global equity portfolios maintain significant exposure to companies central to the AI ecosystem — Microsoft, NVIDIA, Amazon, Meta Platforms, Broadcom, Alphabet, and Taiwan Semiconductor among them.

While AI is one of the structural themes informing our investment thinking, as ever, we remain firmly committed to diversification. Our clients’ portfolios are spread across thousands of securities, assets, sectors, and geographies, ensuring no single trend — no matter how compelling — dominates performance outcomes.

AI is an extraordinary technological force, but, like many major innovations, its commercial impact will take time to fully materialise. The current wave of exuberance has propelled certain companies to extraordinary heights, but the broader business community is still working out how to extract durable value.

Patience, discipline, and strategic clarity will be essential in navigating the transition from AI promise to AI performance.

1 The road ahead, Bill Gates, Nathan Myhrvold, Peter Rinearson, 24 November 1995, Viking Penguin

2 OpenAI's latest funding round and its impact on AI, 3 October 2024, https://lumenalta.com/insights/openai-s-latest-funding-round-and-its-impact-on-ai

3 8 OpenAI statistics (2025): Revenue, valuation, profit, funding, 19 May 2025, https://taptwicedigital.com/stats/openai

4 The gen AI hype cycle: A reality check in 2025? 23 January 2025, https://humanrisks.com/blog/the-gen-ai-hype-cycle-a-reality-check-in-2025/

5 Ibid

6 The economic potential of generative AI: The next productivity frontier, 14 June 2023, McKinsey & Company, https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier

7 Generative AI refers to artificial intelligence systems, such as Microsoft Copilot, ChatGPT, and Grok, designed to create new content, such as text, images, music, or code by learning patterns from existing data.

8 The state of AI: How organizations are rewiring to capture value. 12 March 2025, McKinsey & Company, https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

9 The root causes of failure for artificial intelligence projects and how they can succeed, 13 August 2024, RAND Corporation https://www.rand.org/pubs/research_reports/RRA2680-1.html#citation

10 Unsticking your AI transformation, Bain and Company, https://www.bain.com/insights/unsticking-your-ai-transformation/

11 Engines that move markets: Technology investing from railroads to the internet and beyond, Alasdair Nairn, first published by John Wiley & Sons, 2002

12 Trends — artificial intelligence, BOND, 30 May 2025

13 Visualizing the training costs of AI models over time, 4 June 2024, https://www.visualcapitalist.com/training-costs-of-ai-models-over-time/

14 Trends — artificial intelligence, BOND, 30 May 2025

15 Sources for the below bullet points are International Energy Agency (IEA): Energy and AI report (April 2025) and related analysis provide comprehensive data on electricity demand and AI’s role; McKinsey & Company: Reports on data center investment, power demand, and infrastructure trends (2024–2025); and Goldman Sachs Research: Forecasts on power demand growth and grid investment needs (2024–2025).

16 Goodman Group (GMG.AX): Significant, growing data centre pipeline with strong capital partnerships, Citi Research, 1 July 2025

You may also be interested in

This article has been prepared for OnePath Custodians Pty Limited (OPC) ABN 12 008 508 496, AFSL 238346 as Trustee of the Retirement Portfolio Service (ABN 61 808 189 263). OPC is part of the Insignia Financial group of companies comprising Insignia Financial Limited ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).

The information in this article is current as at September 2025 and may be subject to change.

You should read the relevant Financial Services Guide (FSG), Product Disclosure Statement (PDS), Target Market Determination (TMD), Additional Information Guide (AIG), Investment Funds Guide (IFG), and product and other updates (for open and closed products) available at onepath.com.au and consider whether OnePath products are right for you before making a decision to acquire, or to continue to hold any OnePath product. Alternatively, you can request a copy of this information by calling Customer Services on 133 665.

Taxation law is complex, and this information has been prepared as a guide only and does not represent taxation advice. Please see your tax adviser for independent taxation advice.

Before re-directing your super or moving your money into your product, you will need to consider whether there are any adverse consequences for you, including loss of benefits (e.g. insurance cover), investment options and performance, functionality, increase in investment risks and where your future employer contributions will be paid. Any investment is subject to investment risk, including possible repayment delays and loss of income and principal invested. Returns can go up and down. Past performance is not indicative of future performance.

The information provided is of a general nature and does not take into account your personal needs, financial circumstances or objectives. Before acting on this information, you should consider the appropriateness of the information, having regard to your needs, financial circumstances or objectives. The case studies used in the articles on this website are hypothetical and are not meant to illustrate the circumstances of any particular individual. Opinions expressed in this document are those of the authors only.