We aim to help you understand super and investments so you can be more active in making them grow; let’s start by covering some of the basics. Of course, before making any investment decisions, you should speak to your adviser and read the relevant disclosure documents.

We want you to understand super and investments. Ensuring you understand the fundamentals can benefit your financial outcomes.

Please ensure you read the relevant disclosure documents and speak to your adviser if you require further clarification.

Let’s look at the basics.

In Australia, superannuation or ‘super’ is a long-term investment designed to help you save money during your working life to support your lifestyle in retirement

Super funds offer a range of investment options and asset classes to choose from such as cash, property, shared and fixed interest. A financial adviser can assist you in selecting the right options for your time of life and goals.

By law your employer is obliged to pay at least 10.5% of your earnings to your nominated super fund. This compulsory payment is known as the ‘superannuation guarantee’ (SG). Keep in mind that this rate is set to increase by 1 July 2025 to at least 12%.

| Year | Rate(%) |

|---|---|

2016/17-2020/21 | 9.5 |

2021-2022 | 10.00 |

2022-2023 | 10.5 |

2023-2024 | 11.0 |

2024-2025 | 11.5 |

From 1 July 2025 | 12.0 |

There are two types of contributions allowed into super accounts.

Concessional: These are contributions made from your before-tax income and are taxed at 15% in your super fund.

- Employer contributions (SG)

- Salary sacrifice arrangements

- Any personal super contributions that you claim as a tax deduction

Your concessional contributions cap is currently $27,500 per year.

Non-concessional: These are contributions made from your after-tax income and are not taxed in your super fund.

- Personal voluntary contributions for which you will not claim a tax deduction

- Spouse contributions made on behalf of your spouse

You can make up to $110,000 in non-concessional contributions each year.

Superannuation is a scheme in place to ensure you have savings for when you retire. You must satisfy a ‘condition of release’ to access this money. The main way to meet the release of funds is to reach age 65 or be permanently retired from the work force upon attaining preservation age. You may also access your super in the form of a ‘transition to retirement pension’ upon reaching your ‘preservation age’ even if you have not yet retired.

| Date of birth | Preservation age |

|---|---|

Before 1 July 1960 | 55 |

1 July 1960 - 30 June 1961 | 56 |

1 July 1961 - 30 June 1962 | 57 |

1 July 1962 - 30 June 1963 | 58 |

1 July 1963 - 30 June 1964 | 59 |

From 1 July 1964 | 60 |

In some circumstances you may need to access your super savings early. You will still need meet a condition of release and the withdrawal may be taxable. Please speak to your adviser or visit the ATO website for more information on accessing your super early.

If you have accumulated super whilst temporarily working and residing in Australia, you may apply to withdraw these funds. You can nominate to have these funds paid out as a Departing Australia Superannuation Payment (DASP) withdrawal after you leave. Please note a higher rate of tax may on withdrawals may apply compared to withdrawals under other conditions of release. For more information please visit the ATO website on how to make an application alternatively, please speak to your adviser.

Beneficiary nominations are an important component of managing your super. A beneficiary nomination will ensure that when you pass away, your account balance is paid to a nominated person, in accordance with your wishes. It is important to note that a will does not necessarily control what happens to your super monies upon death.

If you do not have a nominated beneficiary, the trustee of your super fund may decide who receives your super money (often your next of kin) regardless of what is stated in your will. Similarly, even if your nominated beneficiary is incorrect or out of date, the stated nomination may supersede the stated beneficiary in your will.

You are eligible to nominate the following as your beneficiary

- Your current spouse or partner (de-facto)

- Your children

- Someone who you are in an interdependent relationship with

- Anybody who is financially dependant on you when you die

- Your estate or legal personal representative

You can nominate a beneficiary (or beneficiaries) using the Nomination of Beneficiary Form, available on the OnePath website – you can also request the required paperwork over the phone.

For this form to be valid you will need to sign and date it in the presence of two witnesses who are over the age of 18 and not named as the beneficiaries in the form. Please speak to your financial adviser or contact our customer service team for further information.

It’s important to make the right decisions about how you manage your super. With the help of a financial adviser, you can make the right decisions to get the most out of your super savings. .

It’s common for people who have worked at multiple workplaces to have more than one super account. The good news is that you can consolidate these funds using the ATO online portal.

Rolling your super into your OnePath account

If you wish to roll other existing super monies into your OnePath account, you can also do this via a form.

Fill in a Rollover Form for OneAnswer Frontier Personal Super. All the details you need to fill in the form should be on your previous annual statements from your other super providers. If you can’t find your statements, call the other super provider and they will give you the details.

Having your super with OnePath means you have access to a wide range of member services including:

- a wide selection of investment funds

- comprehensive insurance options

- competitive fees

It’s important to note that if you have not already linked your account with your tax file number (TFN) you may be paying more tax than you need to. While you are not legally obliged to provide us with your TFN you may be paying more tax than you need to.

What happens if we don’t have your TFN?

- You may be paying extra tax on your super contributions.

- We cannot accept additional contributions you make into your super.

- You will not be able to receive the Government co-contribution in your super account with us, if eligible.

How do I check if OnePath has my TFN?

- Check your latest OnePath super statement.

- Login to My OnePath > Personal details.

- Call us on 133 665 (Integra Super and OneAnswer Personal Super).

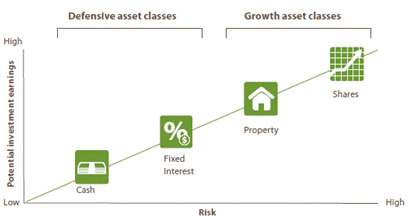

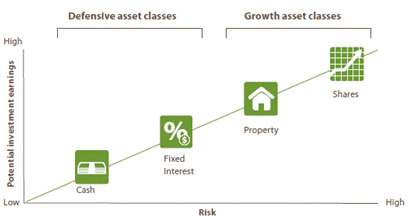

Through your super you have the ability to choose different investment type(s). These investment types are categorised into asset classes indicated in the table below.

The type of asset classes you invest in determine the level of risk, and potential returns you could receive. For example, low level risk asset classes have a lower level of potential return, whereas investing in high-risk options may come with higher returns.

Make an informed choice

- Login to Account Access to find out what investment fund(s) you are currently invested in.

- Learn more about the funds available in OneAnswer Frontier Personal Super.

- Read the relevant Product Disclosure Statement for OneAnswer Frontier Personal Super and consider whether that particular product and investment option is right for you.

- Talk to your financial adviser - they can help ensure the funds you are invested in are right for your needs, financial circumstance and objectives.

You can change your investment funds via Account Access or download the form for OneAnswer Frontier Personal Super.

Every Australian wants to live a secure and comfortable retirement that they can enjoy. Making the right financial decisions and planning can make an impact on how you live in retirement.

It’s never too late to start planning for your retirement. Whether you’re just about ready to retire or not quite there yet, it’s critical you ask yourself the right questions to begin your planning.

Here are some important questions to ask yourself.

- How soon would you like to retire?

- What do you plan to do with your time when you retire?

- How much super do you have?

- How many years of retirement do you need to plan for?

- Are you thinking of working part-time?

- Will you be making any big purchases like a house, car or holiday?

- Will you access the age pension or other Centrelink benefits?

Every individual has different retirement needs. Depending on your lifestyle – and desired lifestyle in retirement – you will have different factors to consider. With the assistance of your adviser, you can plan to achieve your retirement needs.

However, there is also a guide provided by the Association of Superannuation Funds of Australia (ASFA) that shows you how much a standard comfortable retirement can look like.

To view the full ASFA guide (the ASFA Retirement Standard) click here. The Retirement Standard is updated quarterly to reflect the consumer price index (CPI).

To help you work out if you have enough for retirement, and for tips and strategies to improve your retirement savings, speak to your financial adviser.

You are eligible to withdraw your super monies once you reach age 60 however, for people born before 30 June 1964 if you have declared retirement from the workforce you can access your money sooner.

| Date of birth | Preservation age |

|---|---|

Before 1 July 1960 | 55 |

1 July 1960 - 30 June 1961 | 56 |

1 July 1961 - 30 June 1962 | 57 |

1 July 1962 - 30 June 1963 | 58 |

1 July 1963 - 30 June 1964 | 59 |

1 July 1964 onwards | 60 |

Once you’re ready to retire you have a few decisions to make about to what you do with your super money. You can:

Take it in the form of a retirement income stream.

- Withdraw your super as a lump sum.

- A combination of both.

It’s always important to consider any tax implications and impacts to your Centrelink arrangements when accessing this money. Please speak to your adviser to help assist in making the right decision for you.

Investing can be a great way to make your money work for you in the long-term. The goal of investing is to put your money to work over time. It’s important to make sure you invest in what’s right for you.

Simple steps to consider when beginning to invest

- Identify your personal and financial goals

- Make a budget and work out how much you have to invest

- Work out what sort of investor you are and how much risk you're willing to take

- Start investing. The sooner you start, the sooner you'll reach your goals

- Get good advice. A financial adviser can develop a plan tailored to your personal needs and goals.

A great place to start is ensuring you work out your personal and financial goals. This could be saving for a home, education or to support yourself or your family in the future.

Your financial adviser can help to guide you in the right direction based on your personal circumstances.

The ASIC MoneySmart website can provide you with helpful tips to get you started with investing.

You can start investing with a relatively small amount. The earlier you start, the better, as generally time helps to grow investments, however, it’s never too later to start to build your investment portfolio.

A hard truth about investing is that the money you can save or invest is the money you don’t spend.

Setting a budget is the best way to ensure your investments align with your lifestyle and your investment goals.

- identify surplus money that can be used for investing

- see where your money is being spent, and help you decide whether to continue spending money in the same way, or reduce your outgoings and increase your savings

- cope with surprise expenses

- manage your finances and give you more confidence in your financial future.

Asset classes

Asset classes are a group of investment types that exhibit alike features in the current marketplace. These classes are expected to have similar risk and returns and perform in a similar manner under the market conditions.

The four main types of asset classes are:

Cash

Cash is the generic term for investments such as short-term bank deposits and treasury notes. Cash is considered the least risky of the major asset classes – generally providing investors with a moderate regular income, but little chance of capital gain.

Fixed interest

Fixed interest investments, or bonds, are effectively loans provided by investors to corporations and government bodies in return for interest payments over the life of the bond. Bonds carry a low to medium risk, and predominantly reward investors with a regular income stream – generally higher than that earned by cash investments.

Property

Property is considered a growth asset, and involves investing in residential or commercial property, or via a listed property trust (LPT). LPTs invest in a range of property – including residential housing, shopping centres, office buildings, factories, and hotels. As property is a growth investment, capital gains may be expected over the long term, in addition to ongoing income from rent. Property is considered moderately volatile.

Shares

Shares are securities representing ownership of a company. When you buy a share in a company, you become a joint owner of the business. As a shareholder, you may enjoy the company's profits through dividends. You can also sell the shares, hopefully for a capital gain, sometime in the future. Shares are the most volatile of the major asset classes in the short term but can outperform other asset classes over the longer term.

A managed fund is a type of investment scheme where investors’ money is formed together in a single investment pool. Specialist investors then manage the money on behalf of the investors across a range of asset classes.

Managed funds offer a range of benefits including:

- Diversification – invest across a range of asset classes

- Access to experts – who make and manage the investments on your behalf

- Convenience – paperwork and administration is handled by your fund manager

- Access to major investment classes – a managed fund can give you access to international and local investment opportunities

- Economies of scale – managed funds possess buying power when the dollars of investors are pooled together which may not be available to the individual.

By investing in a managed fund, you can benefit from a diversified portfolio beyond what most investors could achieve themselves. You can also save yourself the time, cost and effort of managing your portfolio.

With the guidance of your adviser, you will be able to choose the funds best suited to your needs at the time.

Everyone has different reasons for wanting to invest. It may be to save for a specific goal or just to have money set aside for the long-term. Whatever the reason there are some basic principles that are always good to keep top of mind.

Five simple rules for investing in volatile markets

There are some simple rules that investors have been using to help build long-term wealth for decades.

1. Stay calm

Do not rush any investment decision.

2. Diversify your investments

It’s notoriously difficult to predict what’s going to be the best-performing asset class in any given year. Diversifying investments across asset classes allows you to benefit from each year’s best performers. It can also help you smooth out the volatility of your returns.

3. Spend time in the market

One of the most powerful features of long-term investing is the ability to benefit from compound returns. By staying invested, as opposed to regularly entering and exiting the market, your investments have more time to grow and earn returns on your returns.

4. Monitor and review your investment strategy

It’s a good idea to regularly review your financial plan to make sure it’s still right for your current financial situation and that you’re on track to achieve your goals.

5. Seek professional financial advice

A financial adviser can help ensure your strategy meets your needs, and even help you update it as your circumstances change. With a clearly defined strategy and goals, you can have the confidence you need to withstand market fluctuations.

If you’re an employer, it’s useful to know how superannuation works. This will ensure you’re complying with legislative requirements.

The minimum amount of super (also known as the 'superannuation guarantee') you need to pay is based on 10.5% your employee's 'ordinary time earnings' – that is, earnings for hours they normally work. This rate is set to increase to at least 12% by 1 July 2025. These amounts must be paid into your employee’s nominated or ‘stapled’* super fund at least quarterly to avoid penalties.

You will pay your employees super if they work full time, part-time or on a casual basis

However, payments are not required for employees under age 18 unless they work at least 30 hours in a week.

The super payments you make for your employees are generally tax-deductible in the financial year you pay them. For full details of your super obligations, read the Australian Taxation Office’s Super for employers .

* From 1 November 2021, superannuation ‘stapling’ rules apply, which determine the super fund into which employer contributions are made. If a new employee doesn’t choose a super fund, employers are required to make contributions to the employee’s ‘stapled’ super fund (if they have one).

You can pay your own super if you’re an employer however, you don’t have to. It’s important to consider that if you do not pay your own super you might not be able to have the retirement you desire.

Since 1 July 2005, employees have been allowed to nominate their own super fund, meaning employers must pay into the super fund of their employees’ choice.

If your employee does not nominate a fund and you are unable to locate your employee’s existing ‘stapled’ super fund via the ATO website, you must make all super guarantee contributions to a ‘default’ super fund that you choose. OnePath can help you set up a default fund for your employees - click here for more information.

We want you to understand super and investments. Ensuring you understand the fundamentals can benefit your financial outcomes.

Please ensure you read the relevant disclosure documents and speak to your adviser if you require further clarification.

Let’s look at the basics.

In Australia, superannuation or ‘super’ is a long-term investment designed to help you save money during your working life to support your lifestyle in retirement

Super funds offer a range of investment options and asset classes to choose from such as cash, property, shared and fixed interest. A financial adviser can assist you in selecting the right options for your time of life and goals.

By law your employer is obliged to pay at least 10.5% of your earnings to your nominated super fund. This compulsory payment is known as the ‘superannuation guarantee’ (SG). Keep in mind that this rate is set to increase by 1 July 2025 to at least 12%.

| Year | Rate(%) |

|---|---|

2016/17-2020/21 | 9.5 |

2021-2022 | 10.00 |

2022-2023 | 10.5 |

2023-2024 | 11.0 |

2024-2025 | 11.5 |

From 1 July 2025 | 12.0 |

There are two types of contributions allowed into super accounts.

Concessional: These are contributions made from your before-tax income and are taxed at 15% in your super fund.

- Employer contributions (SG)

- Salary sacrifice arrangements

- Any personal super contributions that you claim as a tax deduction

Your concessional contributions cap is currently $27,500 per year.

Non-concessional: These are contributions made from your after-tax income and are not taxed in your super fund.

- Personal voluntary contributions for which you will not claim a tax deduction

- Spouse contributions made on behalf of your spouse

You can make up to $110,000 in non-concessional contributions each year.

Superannuation is a scheme in place to ensure you have savings for when you retire. You must satisfy a ‘condition of release’ to access this money. The main way to meet the release of funds is to reach age 65 or be permanently retired from the work force upon attaining preservation age. You may also access your super in the form of a ‘transition to retirement pension’ upon reaching your ‘preservation age’ even if you have not yet retired.

| Date of birth | Preservation age |

|---|---|

Before 1 July 1960 | 55 |

1 July 1960 - 30 June 1961 | 56 |

1 July 1961 - 30 June 1962 | 57 |

1 July 1962 - 30 June 1963 | 58 |

1 July 1963 - 30 June 1964 | 59 |

From 1 July 1964 | 60 |

In some circumstances you may need to access your super savings early. You will still need meet a condition of release and the withdrawal may be taxable. Please speak to your adviser or visit the ATO website for more information on accessing your super early.

If you have accumulated super whilst temporarily working and residing in Australia, you may apply to withdraw these funds. You can nominate to have these funds paid out as a Departing Australia Superannuation Payment (DASP) withdrawal after you leave. Please note a higher rate of tax may on withdrawals may apply compared to withdrawals under other conditions of release. For more information please visit the ATO website on how to make an application alternatively, please speak to your adviser.

Beneficiary nominations are an important component of managing your super. A beneficiary nomination will ensure that when you pass away, your account balance is paid to a nominated person, in accordance with your wishes. It is important to note that a will does not necessarily control what happens to your super monies upon death.

If you do not have a nominated beneficiary, the trustee of your super fund may decide who receives your super money (often your next of kin) regardless of what is stated in your will. Similarly, even if your nominated beneficiary is incorrect or out of date, the stated nomination may supersede the stated beneficiary in your will.

You are eligible to nominate the following as your beneficiary

- Your current spouse or partner (de-facto)

- Your children

- Someone who you are in an interdependent relationship with

- Anybody who is financially dependant on you when you die

- Your estate or legal personal representative

You can nominate a beneficiary (or beneficiaries) using the Nomination of Beneficiary Form, available on the OnePath website – you can also request the required paperwork over the phone.

For this form to be valid you will need to sign and date it in the presence of two witnesses who are over the age of 18 and not named as the beneficiaries in the form. Please speak to your financial adviser or contact our customer service team for further information.

It’s important to make the right decisions about how you manage your super. With the help of a financial adviser, you can make the right decisions to get the most out of your super savings.

It’s common for people who have worked at multiple workplaces to have more than one super account. The good news is that you can consolidate these funds using the ATO online portal.

Rolling your super into your OnePath account

If you wish to roll other existing super monies into your OnePath account, you can also do this via a form.

Fill in a Rollover Form for OneAnswer Frontier Personal Super. All the details you need to fill in the form should be on your previous annual statements from your other super providers. If you can’t find your statements, call the other super provider and they will give you the details.

Having your super with OnePath means you have access to a wide range of member services including:

- a wide selection of investment funds

- comprehensive insurance options

- competitive fees

It’s important to note that if you have not already linked your account with your tax file number (TFN) you may be paying more tax than you need to. While you are not legally obliged to provide us with your TFN you may be paying more tax than you need to.

What happens if we don’t have your TFN?

- You may be paying extra tax on your super contributions.

- We cannot accept additional contributions you make into your super.

- You will not be able to receive the Government co-contribution in your super account with us, if eligible.

How do I check if OnePath has my TFN?

- Check your latest OnePath super statement.

- Login to My OnePath > Personal details.

- Call us on 133 665 (Integra Super and OneAnswer Personal Super).

Through your super you have the ability to choose different investment type(s). These investment types are categorised into asset classes indicated in the table below.

The type of asset classes you invest in determine the level of risk, and potential returns you could receive. For example, low level risk asset classes have a lower level of potential return, whereas investing in high-risk options may come with higher returns.

Make an informed choice

- Login to Account Access to find out what investment fund(s) you are currently invested in.

- Learn more about the funds available in OneAnswer Frontier Personal Super.

- Read the relevant Product Disclosure Statement for OneAnswer Frontier Personal Super and consider whether that particular product and investment option is right for you.

- Talk to your financial adviser - they can help ensure the funds you are invested in are right for your needs, financial circumstance and objectives.

You can change your investment funds via Account Access or download the form for OneAnswer Frontier Personal Super.

Every Australian wants to live a secure and comfortable retirement that they can enjoy. Making the right financial decisions and planning can make an impact on how you live in retirement. Every Australian wants to live a secure and comfortable retirement that they can enjoy. Making the right financial decisions and planning can make an impact on how you live in retirement.

It’s never too late to start planning for your retirement. Whether you’re just about ready to retire or not quite there yet, it’s critical you ask yourself the right questions to begin your planning.

Here are some important questions to ask yourself.

- How soon would you like to retire?

- What do you plan to do with your time when you retire?

- How much super do you have?

- How many years of retirement do you need to plan for?

- Are you thinking of working part-time?

- Will you be making any big purchases like a house, car or holiday?

- Will you access the age pension or other Centrelink benefits?

Every individual has different retirement needs. Depending on your lifestyle – and desired lifestyle in retirement – you will have different factors to consider. With the assistance of your adviser, you can plan to achieve your retirement needs.

However, there is also a guide provided by the Association of Superannuation Funds of Australia (ASFA) that shows you how much a standard comfortable retirement can look like.

To view the full ASFA guide (the ASFA Retirement Standard) click here. The Retirement Standard is updated quarterly to reflect the consumer price index (CPI).

To help you work out if you have enough for retirement, and for tips and strategies to improve your retirement savings, speak to your financial adviser.

You are eligible to withdraw your super monies once you reach age 60 however, for people born before 30 June 1964 if you have declared retirement from the workforce you can access your money sooner.

| Date of birth | Preservation age |

|---|---|

Before 1 July 1960 | 55 |

1 July 1960 - 30 June 1961 | 56 |

1 July 1961 - 30 June 1962 | 57 |

1 July 1962 - 30 June 1963 | 58 |

1 July 1963 - 30 June 1964 | 59 |

1 July 1964 onwards | 60 |

Once you’re ready to retire you have a few decisions to make about to what you do with your super money. You can:

Take it in the form of a retirement income stream.

- Withdraw your super as a lump sum.

- A combination of both.

It’s always important to consider any tax implications and impacts to your Centrelink arrangements when accessing this money. Please speak to your adviser to help assist in making the right decision for you.

Investing can be a great way to make your money work for you in the long-term. The goal of investing is to put your money to work over time. It’s important to make sure you invest in what’s right for you.

Simple steps to consider when beginning to invest

- Identify your personal and financial goals

- Make a budget and work out how much you have to invest

- Work out what sort of investor you are and how much risk you're willing to take

- Start investing. The sooner you start, the sooner you'll reach your goals

- Get good advice. A financial adviser can develop a plan tailored to your personal needs and goals.

A great place to start is ensuring you work out your personal and financial goals. This could be saving for a home, education or to support yourself or your family in the future.

Your financial adviser can help to guide you in the right direction based on your personal circumstances.

The ASIC MoneySmart website can provide you with helpful tips to get you started with investing.

You can start investing with a relatively small amount. The earlier you start, the better, as generally time helps to grow investments, however, it’s never too later to start to build your investment portfolio.

A hard truth about investing is that the money you can save or invest is the money you don’t spend.

Setting a budget is the best way to ensure your investments align with your lifestyle and your investment goals.

- identify surplus money that can be used for investing

- see where your money is being spent, and help you decide whether to continue spending money in the same way, or reduce your outgoings and increase your savings

- cope with surprise expenses

- manage your finances and give you more confidence in your financial future.

Asset classes

Asset classes are a group of investment types that exhibit alike features in the current marketplace. These classes are expected to have similar risk and returns and perform in a similar manner under the market conditions.

The four main types of asset classes are:

Cash

Cash is the generic term for investments such as short-term bank deposits and treasury notes. Cash is considered the least risky of the major asset classes – generally providing investors with a moderate regular income, but little chance of capital gain.

Fixed interest

Fixed interest investments, or bonds, are effectively loans provided by investors to corporations and government bodies in return for interest payments over the life of the bond. Bonds carry a low to medium risk, and predominantly reward investors with a regular income stream – generally higher than that earned by cash investments.

Property

Property is considered a growth asset, and involves investing in residential or commercial property, or via a listed property trust (LPT). LPTs invest in a range of property – including residential housing, shopping centres, office buildings, factories, and hotels. As property is a growth investment, capital gains may be expected over the long term, in addition to ongoing income from rent. Property is considered moderately volatile.

Shares

Shares are securities representing ownership of a company. When you buy a share in a company, you become a joint owner of the business. As a shareholder, you may enjoy the company's profits through dividends. You can also sell the shares, hopefully for a capital gain, sometime in the future. Shares are the most volatile of the major asset classes in the short term but can outperform other asset classes over the longer term.

A managed fund is a type of investment scheme where investors’ money is formed together in a single investment pool. Specialist investors then manage the money on behalf of the investors across a range of asset classes.

Managed funds offer a range of benefits including:

- Diversification – invest across a range of asset classes

- Access to experts – who make and manage the investments on your behalf

- Convenience – paperwork and administration is handled by your fund manager

- Access to major investment classes – a managed fund can give you access to international and local investment opportunities

- Economies of scale – managed funds possess buying power when the dollars of investors are pooled together which may not be available to the individual.

By investing in a managed fund, you can benefit from a diversified portfolio beyond what most investors could achieve themselves. You can also save yourself the time, cost and effort of managing your portfolio.

With the guidance of your adviser, you will be able to choose the funds best suited to your needs at the time.

Everyone has different reasons for wanting to invest. It may be to save for a specific goal or just to have money set aside for the long-term. Whatever the reason there are some basic principles that are always good to keep top of mind.

Five simple rules for investing in volatile markets

There are some simple rules that investors have been using to help build long-term wealth for decades.

1. Stay calm

Do not rush any investment decision.

2. Diversify your investments

It’s notoriously difficult to predict what’s going to be the best-performing asset class in any given year. Diversifying investments across asset classes allows you to benefit from each year’s best performers. It can also help you smooth out the volatility of your returns.

3. Spend time in the market

One of the most powerful features of long-term investing is the ability to benefit from compound returns. By staying invested, as opposed to regularly entering and exiting the market, your investments have more time to grow and earn returns on your returns.

4. Monitor and review your investment strategy

It’s a good idea to regularly review your financial plan to make sure it’s still right for your current financial situation and that you’re on track to achieve your goals.

5. Seek professional financial advice

A financial adviser can help ensure your strategy meets your needs, and even help you update it as your circumstances change. With a clearly defined strategy and goals, you can have the confidence you need to withstand market fluctuations.

If you’re an employer, it’s useful to know how superannuation works. This will ensure you’re complying with legislative requirements.

The minimum amount of super (also known as the 'superannuation guarantee') you need to pay is based on 10.5% your employee's 'ordinary time earnings' – that is, earnings for hours they normally work. This rate is set to increase to at least 12% by 1 July 2025. These amounts must be paid into your employee’s nominated or ‘stapled’* super fund at least quarterly to avoid penalties.

You will pay your employees super if they work full time, part-time or on a casual basis

However, payments are not required for employees under age 18 unless they work at least 30 hours in a week.

The super payments you make for your employees are generally tax-deductible in the financial year you pay them. For full details of your super obligations, read the Australian Taxation Office’s Super for employers .

* From 1 November 2021, superannuation ‘stapling’ rules apply, which determine the super fund into which employer contributions are made. If a new employee doesn’t choose a super fund, employers are required to make contributions to the employee’s ‘stapled’ super fund (if they have one).

You can pay your own super if you’re an employer however, you don’t have to. It’s important to consider that if you do not pay your own super you might not be able to have the retirement you desire.

Since 1 July 2005, employees have been allowed to nominate their own super fund, meaning employers must pay into the super fund of their employees’ choice.

If your employee does not nominate a fund and you are unable to locate your employee’s existing ‘stapled’ super fund via the ATO website, you must make all super guarantee contributions to a ‘default’ super fund that you choose. OnePath can help you set up a default fund for your employees - click here for more information.

The information is current as at April 2019 but may be subject to change. OneAnswer Frontier Personal Super is issued by OnePath Custodians Pty Limited (OnePath Custodians) ABN 12 008 508 496, AFSL 238346. Neither the issuers, nor any other related or associated company, guarantee the repayment of capital or the performance or any rate of return of the investment. Investments made into the investment options are subject to investment risks and other risks. This could involve delays in the repayment of principal and loss of income or principal invested. Potential investors should read the relevant PDS available by calling 133 665, before deciding whether to acquire, or to continue to hold, the product. This information is of a general nature and has been prepared without taking account of your client’s objectives, financial situation or needs. Your client should consider the appropriateness of the advice, having regard to their objectives, financial situation and needs.

.jpg)